Introduction

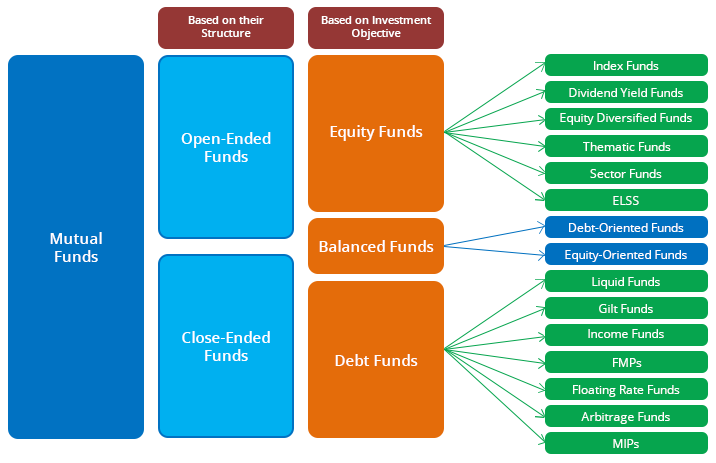

In terms of ease with which investors can enter and exit funds, mutual funds are broadly divided into two classes:

Open-ended funds: Investors can buy and sell the units from the fund, at any point of time.

Close-ended funds: These funds raise money from investors only once. Therefore, after the offer period, fresh investments cannot be made into the fund. If the fund is listed on a stocks exchange the units can be traded like stocks. Recently, most of the New Fund Offers of close-ended funds provided liquidity window on a periodic basis such as monthly or weekly. Redemption of units can be made during specified intervals. Therefore, such funds have relatively low liquidity.

There are various classes of mutual funds depending upon the nature of investments. Here are three broad classes from which one can choose to invest, depending upon his risk-return profile.

Equity funds

Balanced funds

Debt funds

Equity funds

These funds invest in equities and equity related instruments. With fluctuating share prices, such funds show volatile performance, even losses. However, short term fluctuations in the market, generally smoothens out in the long term, thereby offering higher returns at relatively lower volatility. At the same time, such funds can yield great capital appreciation as, historically, equities have outperformed all asset classes in the long term. Hence, investment in equity funds should be considered for a period of at least 3-5 years.

Know more about Equity Funds

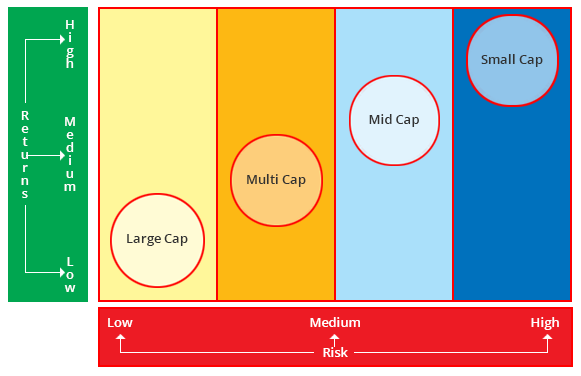

Fund classification based on capitalization focus:

There are also funds based on capitalization which invest in companies falling within a certain segment of market capitalization. Based on capitalization, equity funds can be placed on the risk return grid as shown below:

Debt Funds

They invest only in debt instruments, and are a good option for investors averse to idea of taking risk associated with equities. Therefore, they invest exclusively in fixed-income instruments like bonds, debentures, Government of India securities; and money market instruments such as certificates of deposit (CD), commercial paper (CP) and call money. Put your money into any of these debt funds depending on your investment horizon and needs.

Balanced funds

Arbitrage Funds

FMPs

Arbitrage Funds

Income Funds

Floating rate funds

Gilt funds

Liquid funds

A calculative online financial calculator lanced with the advance feature, which helps to calculate the critical financial calculations and number as well make them easy for users to use.

Downloads

Don’t just see it, have it with you, and make it useful in your way, and with this being says, with the download forms facility users can easily download the form.

Buy MF Online

Buy your mutual fund here and now, with this, user doesn’t have to wander around for their mutual fund. Here they can buy their Mutual Fund online.

Know Your Fitness

How is your financial condition? Are you financially healthy or not? Here is the way to check your financial fitness lets know how your financial condition.

Know Your Risk Profile

Its time to become advance and pay some attention towards your risk profile, because risk is the unavoidable and significant factor of the money market.

Pay Premium Online

Build your investment with paying the little amount of money on the particular times as a premium, and make a secure investment for your mutual fund transaction.